International Life Insurance Form 720

Form 8833 for when form 720 does not apply thanks to a treaty based exemption.

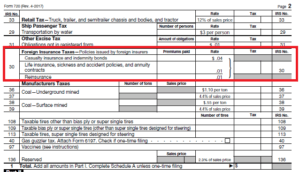

International life insurance form 720. To facilitate their collection of excise taxes the irs created form 720 its quarterly federal excise tax return. Person who buys such a policy is taxed. Form 720 is used for other excise taxes as well. Irc 4371 requires policy holders to file a quarterly excise tax form form 720 to report and pay a 1 excise tax on insurance premiums paid to foreign life insurers.

If you file form 720 to report quarterly excise tax liability for the first third or fourth quarter of the year for example filers reporting the foreign insurance tax irs no. Taxation premiums form 720 the irs levies a 1 excise tax on the foreign life insurance premiums that you pay each year. Look at the irs audit technique webpage for a good overview. The tax is 1 of the premium paid.

The tax is submitted along with a form 720 and is submitted quarterly to the irs. Apart from having to pay tax on your foreign life insurance policy you will also have to report that you have to pay tax on it and report your ownership of it. The excise tax form needs to be completed and filed four times throughout the year. 133 on those filings.

If you are reporting liability in part i or ii of form 720. Foreign life insurance policy non reporting penalties. Form 720 quarterly federal excise tax return form 720 is reported quarterly to the irs in any year that foreign life insurance premiums were paid. 1 of premium paid.

A review of the returns would indicate whether the statute of limitation for the federal insurance excise tax has closed for anyyears. Therefore for each year that you pay foreign life insurance premiums you would submit four 4 form 720s one for each quarter. The irs has the right to issue excessive fines and penalties against you for failing to report. Foreign life insurance form 720.

30 don t make an entry on the line for irs no. Unlike other irs forms such as fbar or fatca form 8938 which are filed irrespective of whether premiums are paid once the aggregate cash value or surrender value thresholds are met form 720 is only filed for life insurance premiums purposes anyway in a quarter in which premiums were paid. The foreign life insurance policy isn t a life insurance for income tax purposes thus taxable but the policy is a life insurance for excise tax purposes. 31 for each respective quarter of a calendar year.

Taking steps to become compliant form 720 is due by april 30 july 31 oct. Attach a statement explaining each claim as required. You are required to file form 720 to report the premium payment and remit your excise tax. Foreign life insurance may be reported with respect to excise tax on form 720.

This is a relatively simpler form with no monster penalties attached to it.