Irs Proof Of Insurance Form For Dependent

Of the following statements must be.

Irs proof of insurance form for dependent. Your dependents are listed in the middle of the first page of your tax return. Name of taxpayer taxpayer identification number. About form 1095 a health insurance marketplace statement internal revenue service. Proof that the child or dependent lived with you for more than half of the year shown on your letter.

Complete this form if you can be claimed as a dependent on someone else s 2019 tax return. Check the box below for first month in your tax year that you elect to take health coverage tax credit hctc. Form 1095 b is used by providers of minimum essential health coverage to file returns reporting information for each individual for whom they provide coverage. Form 1095 information forms.

Form 1095 b is used to report certain information to the irs and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment. Check the full year coverage box on your tax return if the form shows coverage for you and everyone in your family for the entire year. Part i election to take the health coverage tax credit. Define the dependent s gross income.

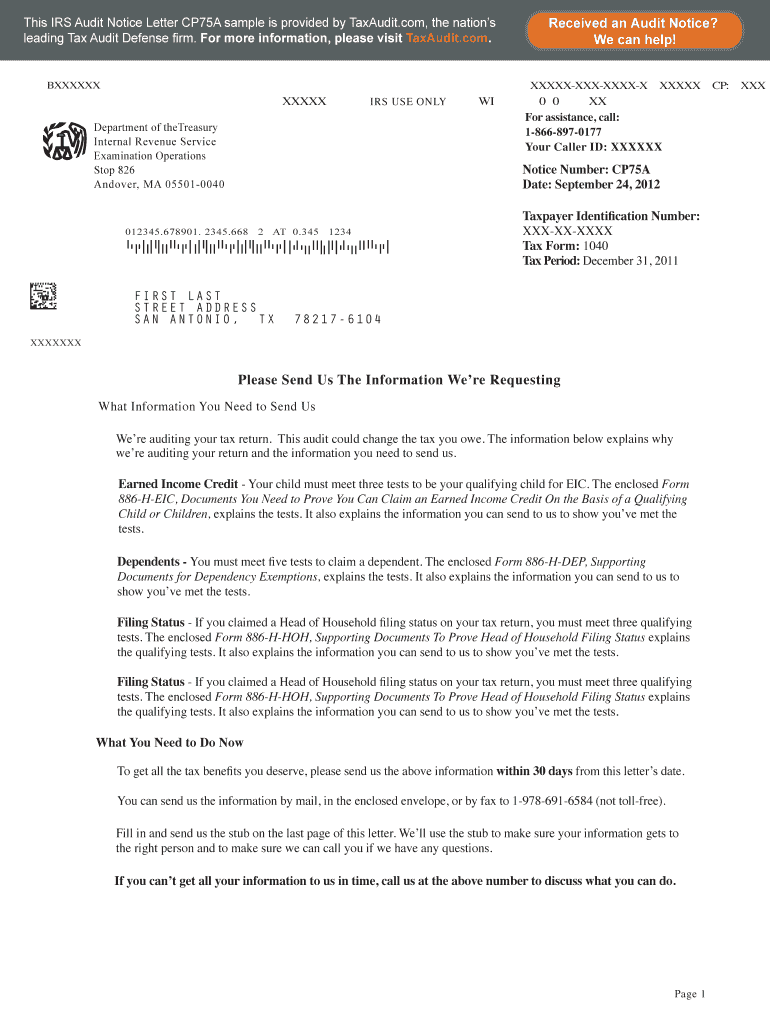

Health insurance marketplaces furnish form 1095 a to. Proof of your relationship to the child or dependent and. For every child or dependent you re claiming a credit for you must send us. If the custodial parent releases a claim to exemption for a child the noncustodial parent may claim the child as a dependent and as a qualifying child for the child tax credit or credit for other dependents.

You must also show that you paid for more than 50 percent of the dependent s support for the year. In order to claim an exemption for a qualifying relative he cannot have earned above 3 300 per year. April 2019 department of the treasury internal revenue service. The form 886 h dep lists all the documents or combination of documents you can use to prove you can claim each child listed as your dependent.

Received a form 1095 a health insurance marketplace statement and did not receive advance payments of the credit. To claim a child as a dependent qualifying child the child must have lived with you for more than half the tax year the residency test be related to you the relationship test be a certain age the age test. You are not required to send the irs information forms or other proof of health care coverage when filing your tax return. However it s a good idea to keep these records on hand to verify coverage.

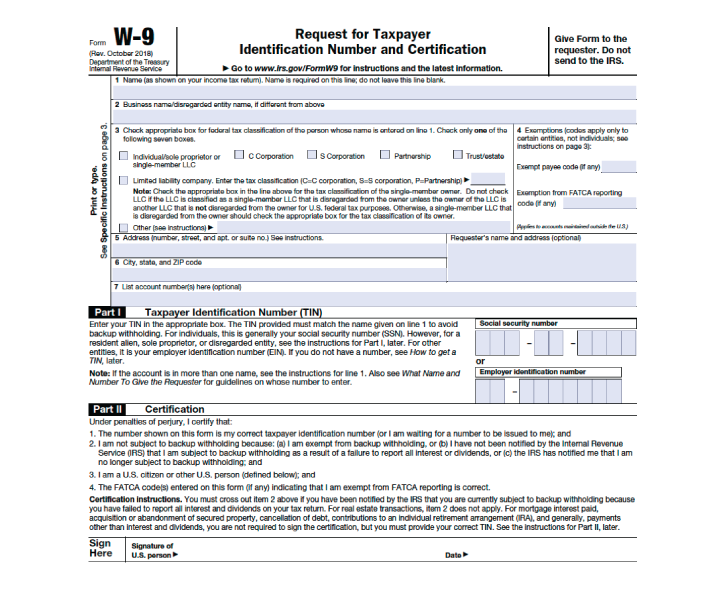

Statements from your insurer. A copy of a w 2 form is an appropriate document to show this. Form 1095 a is used to report certain information to the irs about individuals who enroll in a qualified health plan through the marketplace. Supporting documents to prove the child tax credit ctc and credit for other dependents odc for 2018 2025.

Documentation for proving you have a child or dependent. The next item is the dependents you claimed.