Self Employed Health Insurance Form 1040

To make the discussion easier let s say the value listed here is 200.

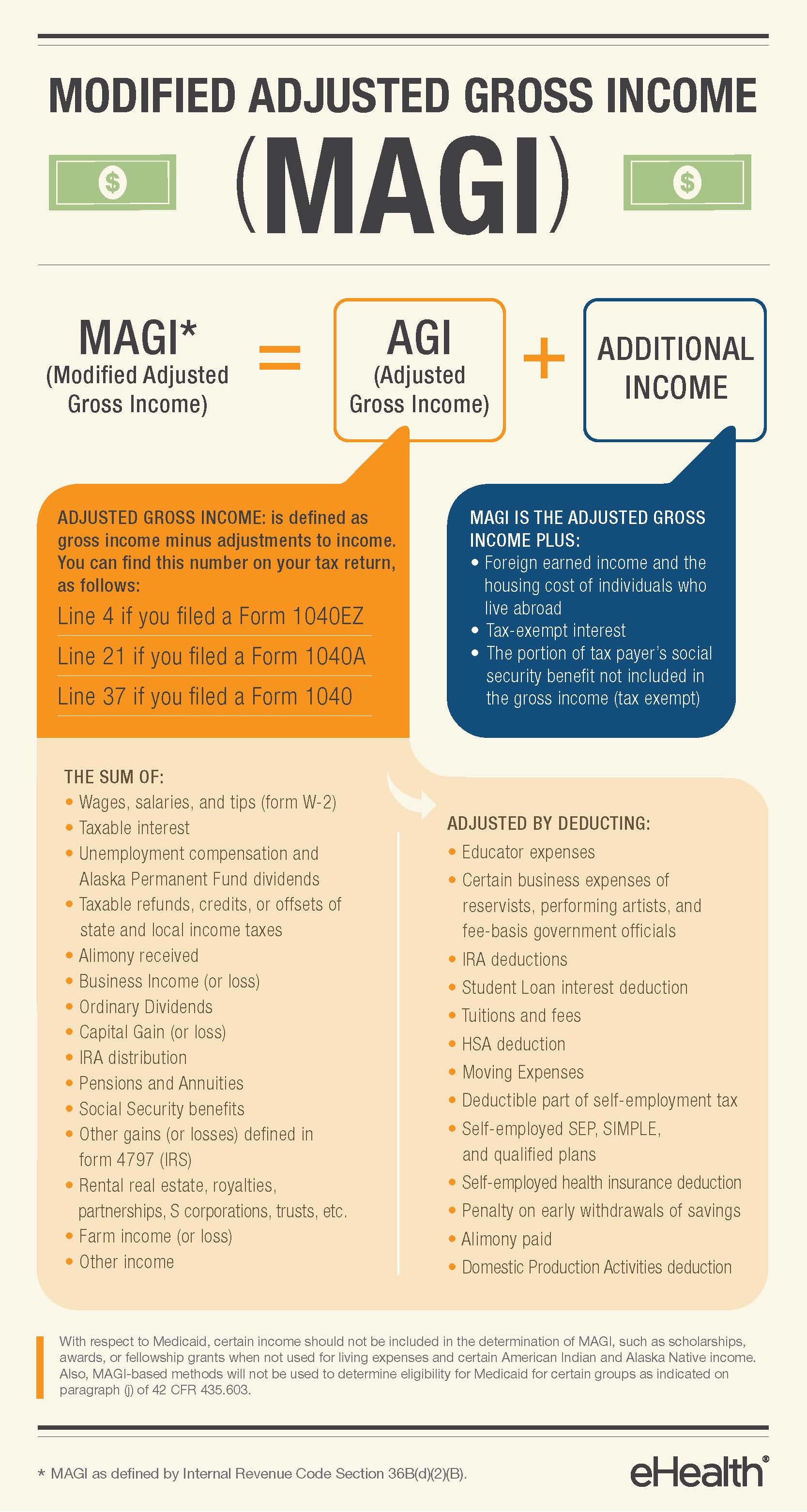

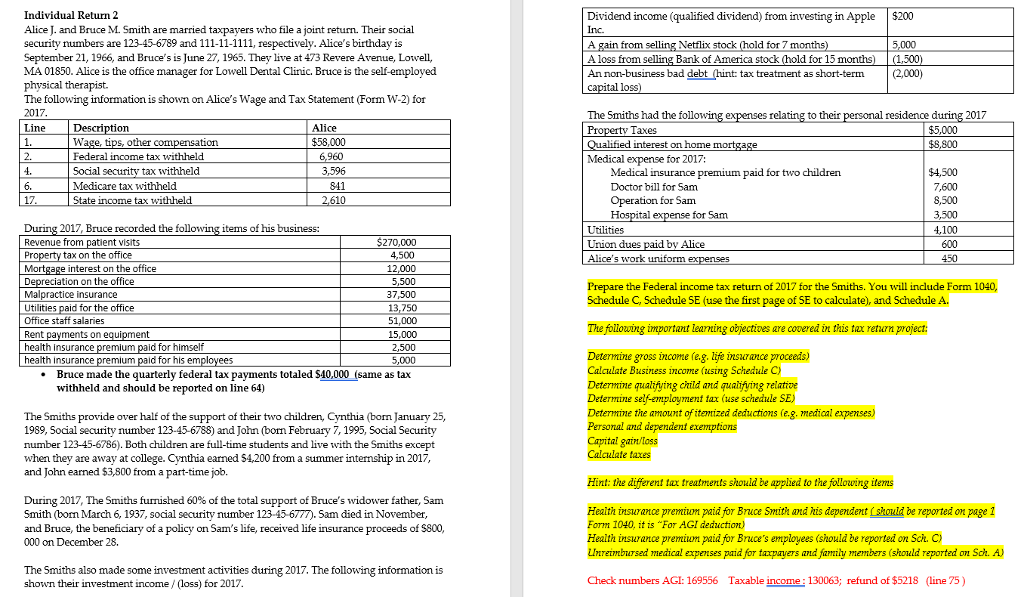

Self employed health insurance form 1040. Entering individual self employed health insurance premiums from s corporation schedule k 1. The following articles are the top questions regarding self employed health insurance form 1040 schedule 1 line 29. Self employed health insurance deduction worksheet form 1040 schedule 1 instructions html. The insurance policy can be issued in the business name or in your name.

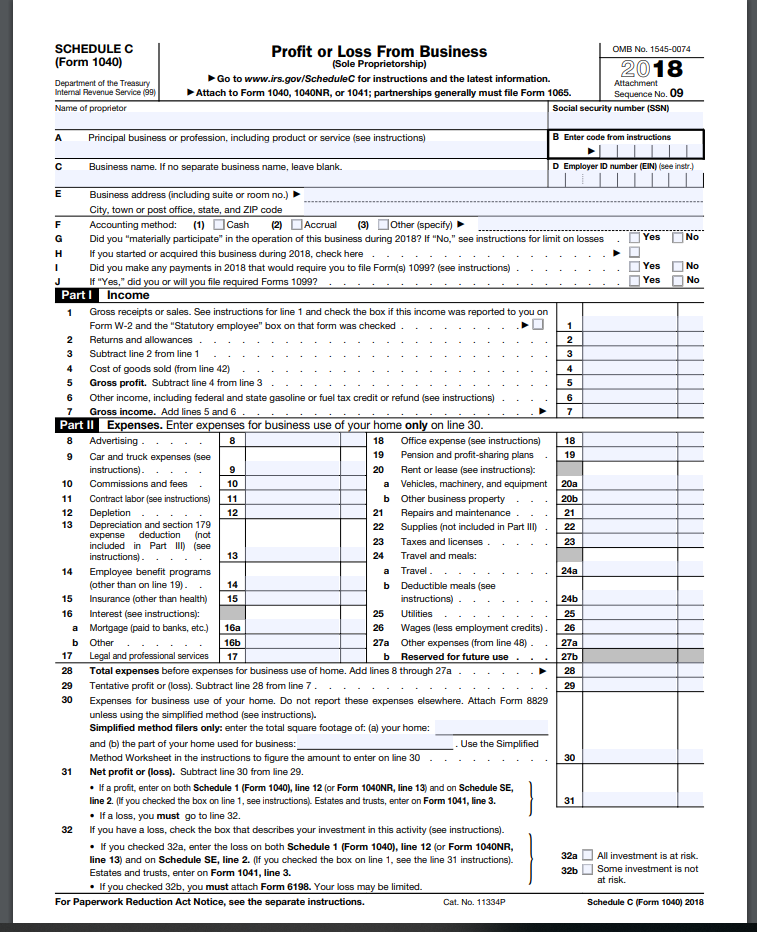

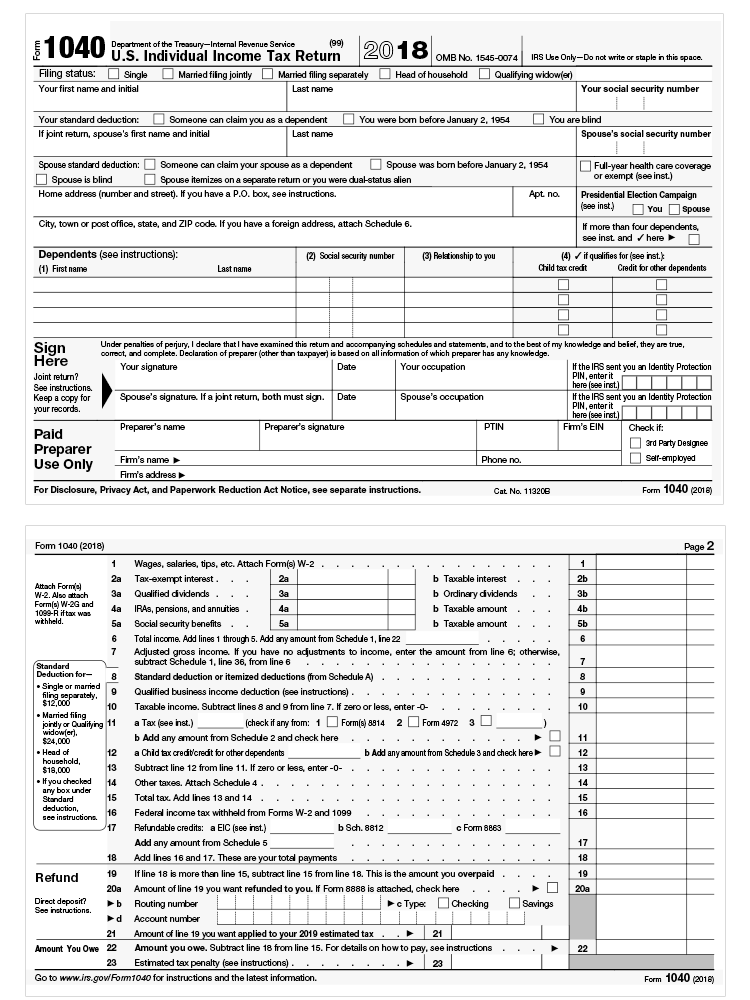

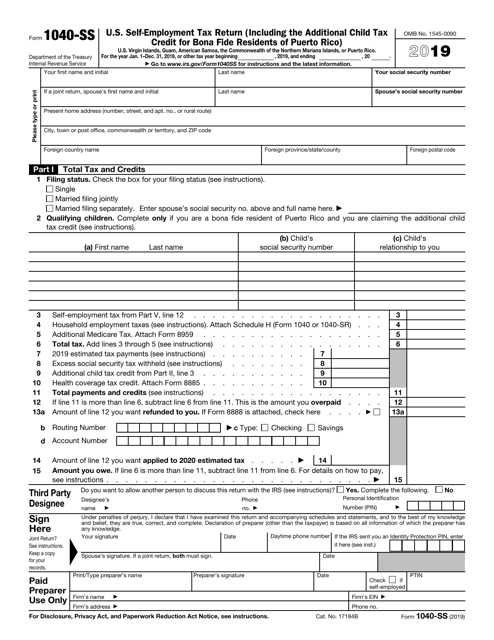

Form 1040 line 29 self employed health insurance deduction calculation. Form 1040 line 29. 2018 self employed health insurance deduction worksheet. That means you can take advantage of the tax benefit even if you don t itemize deductions.

Generating se health insurance deduction for 1040 line 29. The program uses self employed income from all sources as indicated on line 4 of the self employed health insurance deduction form 1040 line 29 worksheet to calculate the deduction. The lacerte tax program will show the calculation of the self employed health insurance deduction in the worksheets generated with the forms. Health dental and long term care premiums.

Does my business have to hold the policy. As you probably already know independent workers generally don t have access to employer sponsored health insurance and the lower group rates that come with them so they usually purchase health insurance individually. Form 8962 line 26 will show the resulting over under tax credit and be transfered to your 1040 line 69. After inputting my 1095 a information i went to the 1040 line 29 worksheet and input my medicare wages on line b.

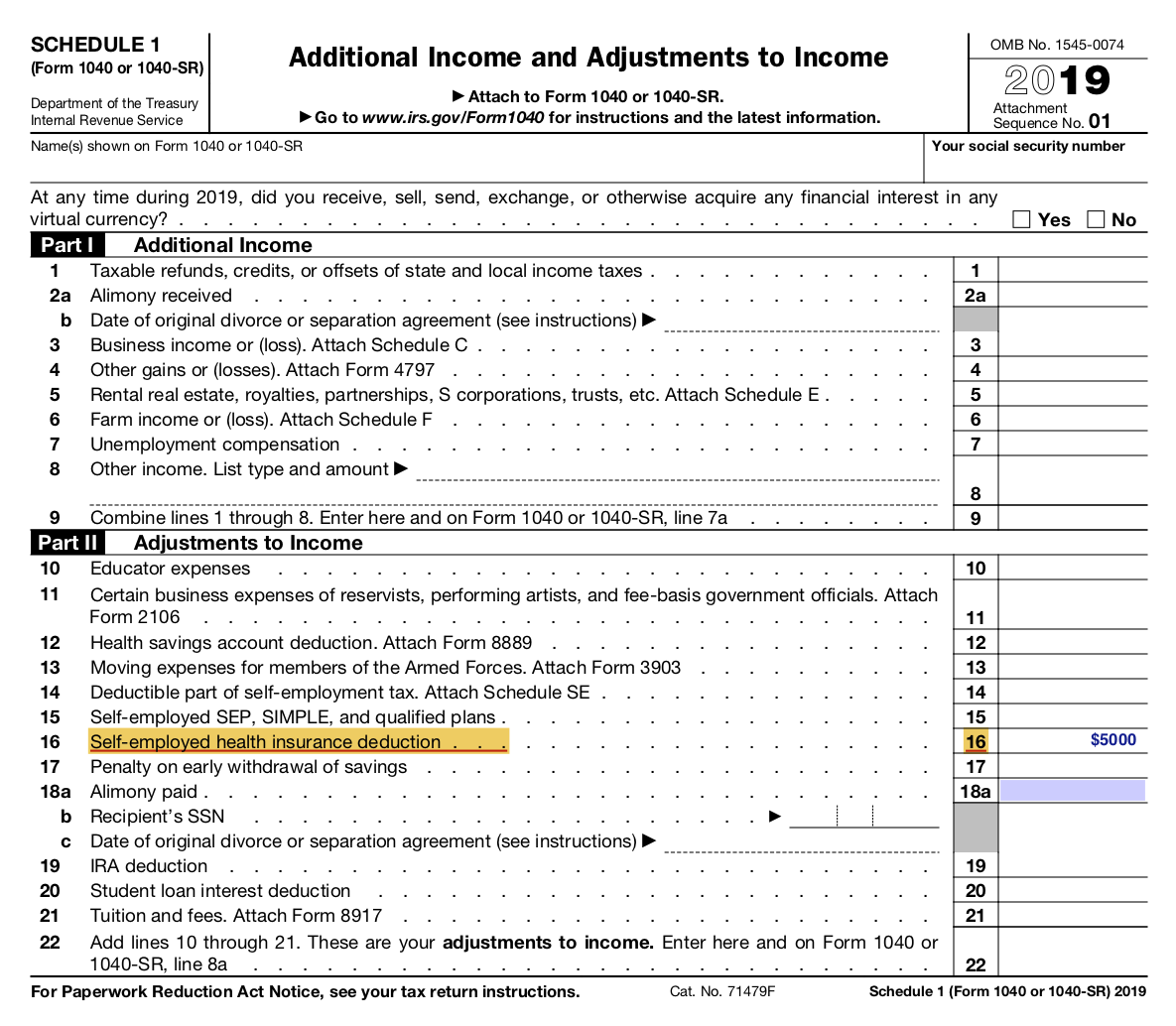

By default the program limits this se health insurance deduction to the lesser of the total premiums entered or the net earnings from self employment minus qualified retirement plans and one half of the self employment deduction on form 1040. After doing this the text at the bottom of the worksheet gave me my adjustment which was placed on 1040 line 29 self employed health insurance deduction. How is self employed health insurance deduction calculated on box 29 1040 form in general for the health insurance premiums you can deduct up to 100 of the premiums for you your spouse and your dependents if your work shows a net profit. Self employed health insurance deduction 1040 sched 1 line 16 unexplained value on form 1040 schedule 1 line 16 turbotax has generated a value that doesn t seem to come from anywhere.