Which Insurance Form Be Used To Cover Contents Only

Special perils contents coverage will cover breakage of all but fragile items.

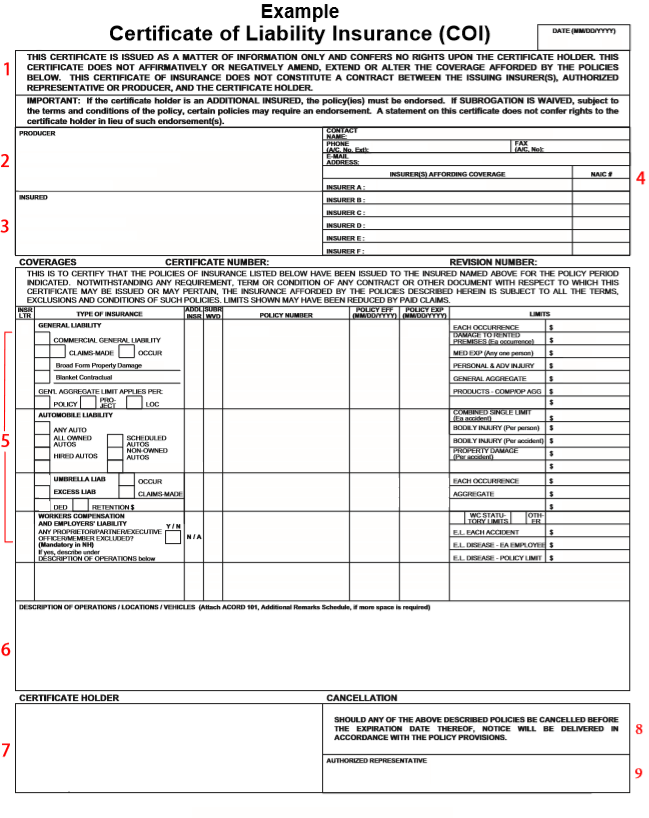

Which insurance form be used to cover contents only. Links for irmi online subscribers only. So if the contents coverage is 40 percent and the home is insured for 600 000 then your belongings would be insured for 240 000. The good news is that renters homeowners and condo insurance policies typically include coverage for the contents of your home. If you re shipping your vehicle ask the auto shipping company for their insurance certificate they are required by law to have one.

The most widely used iso commercial property coverage forms are the building and personal property coverage form cp 00 10 and the business income and extra expense coverage form cp 00 30. A contents insurance policy is meant to cover your personal belongings. Building and personal property coverage form is a type of commercial insurance policy designed to cover direct physical damage or loss to commercial property and its contents. There are separate deductibles for your.

This coverage is sometimes known as contents insurance but is usually described in most insurance policies as personal property coverage. Deductibles on your personal property. A floater will fully protect high value items such as jewelry collectibles china vases fine art etc. Federal flood insurance coverage is also capped at 250 000 per building and 100 000 for contents though you can purchase policies with lower limits.

Cpi v e v m vi c. Make sure and inquire about these items specifically so you know if you need to add coverage or if it is already included. Forms to assess damage submitted for insurance claims.