Business Interruption Insurance Formula

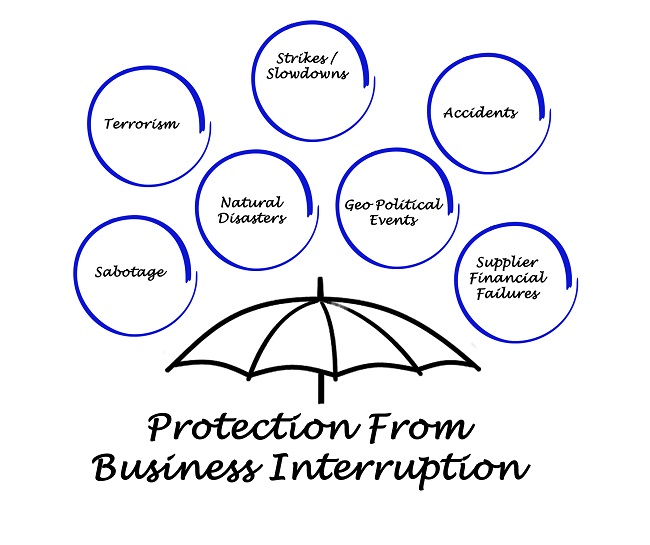

Insurance coverage for loss of business income and extra expenses is typically provided when the loss is due to suspension of operations and direct physical loss of property unless excluded.

Business interruption insurance formula. Business interruption insurance is insurance coverage that replaces business income lost in a disaster. The event could be for example a fire or a natural disaster. Typically the business income covered is classified as taxable income. Generally speaking policies.

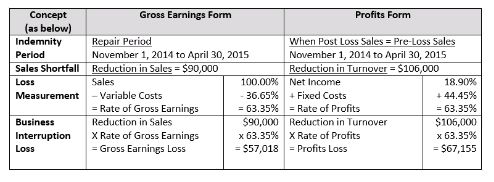

Business interruption insurance covers the gross profit loss during the period of interruption or the period of restoration. Bi business interruption and. Bi t x q x v where. This is the time period where operations are interrupted due to the loss of physical assets and those physical assets are either in the process of being repaired or being replaced.

Lost sales expenses saved as a result of not accruing the sales aka top down approach one way to calculate loss revenue from a business interruption is to determine the difference in sales and then subtracting the expenses saved as a result of not having the sales. The business interruption formula can be summarized as follows. T the number of time units hours days operations are shut down q the quantity of goods normally produced or sold per unit of time used in t v the value of each unit of production usually expressed in profit. Exclusions typically include water with elaboration that this means flood surface water tides tidal waves overflow of any body of water all.

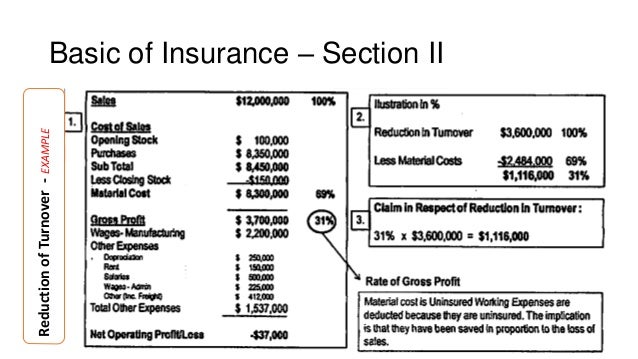

We have used this calculation formula for many years which has proved very helpful to our clients and whilst it will not apply to all situations it will assist in most cases. Calculate the net sales of the business. Business income insurance also known as business interruption coverage helps cover lost income and additional expenses when your business is shut down from a covered loss. Business interruption insurance is not sold as a policy by itself but is usually part of a property insurance or business owners policy.

Normally business interruption insurance covers four key aspects. The intention of business interruption insurance is to put you back into the same financial position you would have been had the damage and consequential interruption not occurred. This figure is arrived at by subtracting adjustments from gross sales. Basic formula 1.

The most your insurer will pay for a loss is the business income limit of insurance. Establishing an accurate gross profit sum insured with your client director broker is essential to the correct operating of a business interruption cover.

/business-interruption-insurance-186783504-dc2ed469d7a84fa682ff2ebb229b1efb.jpg)